Axie Infinity's utilization of a brought together "sidechain" opened up a road of assault.

Axie Infinity designer Sky Mavis declared Tuesday a monstrous break of its Ronin cryptographic money sidechain.

An aggressor utilized "hacked private keys" to get through Ronin's validator network, Sky Mavis says, moving 173,600 ethereum (worth roughly $594 million at current rates) and $25.5 million in USDC stablecoin as a component of probably the biggest break throughout the entire existence of cryptographic money.

To comprehend the idea of that break, let us take you on a compressed lesson in the short history of Axie Infinity and the mind boggling snare of crypto guidelines and advancements that permitted the adventure to occur.

So you can, similar to, bring in cash by playing a game?

Axie Infinity has been refered to as one of the early examples of overcoming adversity in purported blockchain gaming.

Such games utilize decentralized conventions to follow responsibility for in-game things and for the most part allowed players to have some command over the resale of those things.

To play Axie Infinity, players need to buy somewhere around three NFTs of playable in-game Axies on the open market (or acquire them from proprietors).

Playing with those Axies then, at that point, acquires players some Smooth Love Potions (SLP), which can control up Axies or be offered to different players as a product, making a "play to procure" circle.

Last year, there was sufficient publicity and cash sloshing through this framework that a few players in the Philippines had the option to make a respectable neighborhood wage essentially by playing the game as their everyday work.

In any case, that early achievement pulled in additional players who would have liked to bounce on to the play-to-acquire train, which overwhelmed the market with SLPs.

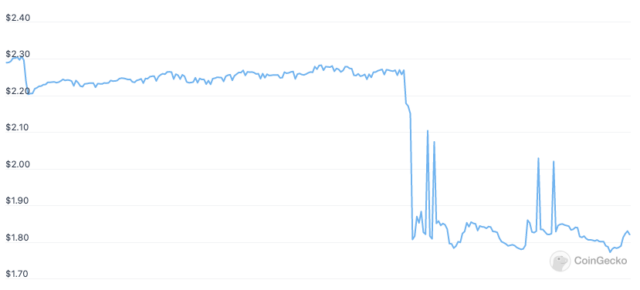

With few new purchasers coming in to buy that large number of SLPs, the worth of the mixtures (in dollars) has cratered approximately 80% since early November and an incredible 95 percent from its pinnacle last May, as indicated by CoinGecko.

With few new purchasers coming in to buy that large number of SLPs, the worth of the mixtures (in dollars) has cratered approximately 80% since early November and an incredible 95 percent from its pinnacle last May, as indicated by CoinGecko.

As the SLP's worth has cratered, along these lines, as well, has the quantity of day to day dynamic Axie Infinity players and the quantity of new players purchasing new Axies.

(For substantially more on how the Axie economy capacities, and how it goes to pieces without new players who need to purchase SLPs, read through this extensive report from consultancy Naavik.)

The point of failure in the (side)chain

While Axie Infinity initially ran straightforwardly on the ethereum blockchain, the high exchange costs and slow exchange speeds on that network immediately became indefensible as the game developed.

To get around those expenses, Sky Mavis in 2020 began to utilize a sidechain — an equal private blockchain running on top of ethereum that could sidestep the need to pay ethereum "gas" for every single exchange.

Sky Mavis at first banded together with Loom Networks for this sidechain usefulness. In March 2020, however, the organization broke that association and presented its own sidechain called Ronin.

Not at all like the disseminated confirmation of-work ethereum blockchain, the Ronin sidechain works on a significantly more brought together verification of-authority framework.

Not at all like the disseminated confirmation of-work ethereum blockchain, the Ronin sidechain works on a significantly more brought together verification of-authority framework.

As opposed to counseling the whole appropriated blockchain organization to affirm exchanges, this verification of-authority framework runs its exchanges through a little arrangement of trusted, handpicked "validator" hubs.

Every hub stakes a portion of its standing on approving every exchange, hypothetically rebuffing solitary entertainers that attempt to game the framework.

Brought together trades like Binance and decentralized trades like Katana permit clients a "span" to move their in-game resources this way and that among Ronin and the fundamental ethereum blockchain.

But since those moves can happen all the more once in a while and at scale, the exchange costs end up much lower.

Ronin's confirmation of-authority framework, brought together in only nine validator hubs, is the way in to its capacity to give a higher volume of exchanges at a much lower cost than the rambling ethereum network.

It additionally turned out to be Ronin's flimsy part, for this situation.

As Sky Mavis makes sense of, the obscure assailant had the option to penetrate Sky Mavis' frameworks and gain full admittance to four validator hubs that the organization controls.

The assailant was then ready to involve an extra secondary passage in those hubs to oversee one more validator constrained by the decentralized Axie DAO.

With that fifth validator hub, the assailant could then give a greater part of approval marks on any exchange it needed, prompting the deceitful exchanges.

The aftermath

While the assault happened last Wednesday, Sky Maven said it didn't become mindful of the issue until early Tuesday, when a client fell flat to move 5,000 ETH from the organization.

"The way that no one notification for six days shouts so anyone might hear that some construction ought to be set up to watch unlawful exchanges,"

Securitize Capital head Wilfred Daye told Bloomberg.

Sky Mavis says that all client tokens on the Ronin organization "are protected at the present time" and that the organization is "working with policing, criminological cryptographers, and our financial backers to ensure all assets are recuperated or repaid."

Until further notice, however, authentic clients can't pull out or store assets to or from the Ronin network on either Katana or Binance.

"The extension will be opened up sometime in the not too distant future once we are sure no assets can be depleted," the organization said.

Furthermore, Sky Mavis additionally says that it is "currently examining with Axie Infinity/Sky Mavis partners about how to best push ahead and guarantee no clients' assets are lost," which sounds somewhat questionable.

In the hours after Sky Mavis' Tuesday morning declaration of the break, the value of Ronin's $RON administration token fell almost 22% to another record-breaking low, as indicated by CoinGecko.

In the hours after Sky Mavis' Tuesday morning declaration of the break, the value of Ronin's $RON administration token fell almost 22% to another record-breaking low, as indicated by CoinGecko.

Indeed, even before that plunge, however, $RON's cost had proactively fallen 36% since it was first presented in late January.

To assist with forestalling comparative assaults from here on out, Sky Mavis said it will currently require eight of nine Ronin validators to settle on all exchanges, as opposed to only an uncovered greater part of five.

The chase

By far most of the Ronin assailant's not well gotten gains are at present sitting in a new ethereum wallet.

A little more than 6,000 ETH has been moved to different addresses, however, which makes them trust that specialists will actually want to follow the cash to nail down the guilty party.

"[The attacker] sent a few tokens to trades which implies there's an opportunity he can be distinguished and dealt with,"

Axie Infinity fellow benefactor Jeff Zirlin said during a show Tuesday at the NFTLA gathering.

The previous summer, a different assault on the well known Polygon sidechain caught generally $600 million in crypto resources, however most of those assets were returned beginning the following day.

In February, a programmer figured out how to take $320 million worth of cryptographic money by taking advantage of the extension between the ethereum and solana blockchains.

Exchanging firm Jump Crypto wound up recharging those subsidizes itself "to restore local area individuals and backing Wormhole now as it keeps on creating."

0 Comments

Write a comment if you liked the topic